Buying travel insurance can be complicated. So there is a need out there in the travel world for travel insurance made easy.

My friend, Sofia had booked a tour of exploring northern Spain. Two days before departure she stepped off the curb at Walmart and twisted her ankle.

At first, she thought it was just a sprain, but it was so painful that she decided to go to the doctor. Turns out she had a fractured fibula. So much for her Spanish adventure.

She had no insurance because “Hey, it’s just Spain, nothing is going to happen there.” She had to cancel her trip and was not reimbursed for the considerable amount of money she spent on her tour.

She didn’t count on something bad happening BEFORE she left, much less at a Walmart where she shopped for decades.

Another friend, Maura, fell asleep with her glasses on in her hotel room in Madrid. During the night, they fell to the floor.

In the morning, Maura got out of bed and promptly stepped on her glasses, destroying them.

Maura has appalling eyesight and could not have continued her Spanish adventure without them. Again, no insurance.

Instead of exploring the Prado, Maura had to spend time and money getting a new pair of glasses in an unfamiliar country.

Table of Contents

ToggleAnd then there’s Sherilyn. Sherilyn had gotten into the habit of buying travel insurance when she saw her sister get reimbursed for the cost of an entire trip she had to cancel due to illness.

Sherilyn too had to cancel for the same reason and she too was fully reimbursed.

The moral of the story is…always get travel insurance. Not having it could turn out to be one of the single worst financial decisions of your life.

Why is Travel Insurance so Important?

Let’s face it, travel insurance is an essential part of the travel experience. It should be part of the travel package along with your tickets and accommodation reservations.

It’s hard to believe that even the most experienced travelers neglect it when researching travel.

You may think you don’t really need it, that it is a “nice to have” rather than a “must have,” but it is key to your well-being while traveling.

First, it gives you peace of mind that you’re covered. Second, it prevents you from suffering large financial losses.

Travel insurance will cover you for those inconveniences like lost luggage, delayed or canceled flights, and important lost, stolen or damaged articles.

It will also cover you for losses due to critically important misfortunes like illness, accidents or a death in the family requiring you to cut your trip short.

As I tell my friends, family, and subscribers, “Get travel insurance. Don’t even think about it!”

Why wouldn’t you invest a relatively small amount of money to protect your investment in travel, not to mention your health and safety?

As a travel blogger and tour operator, I’ve seen several travel experiences ruined due to lack of insurance.

I’ve also seen the opposite, travelers that were covered when the unexpected happened. I can personally vouch for the benefits of travel insurance.

I like to compare policies and prices using Travelinsurance.com to see what insurance makes the most sense for me.

I used travel insurance to cancel a trip to Buenos Aires when my husband got sick and couldn’t make the trip.

I also used it to replace my computer that fell from a balcony in Barcelona and crashed to the ground.

Another time a monkey bit me in Myanmar causing an infection that had to be treated.

Probably the best use of my travel insurance was when a delayed flight caused me to miss a full day’s seminar in Sicily.

Every single time I had an issue, which fortunately was not often, I was reimbursed.

Good, solid coverage exists to make sure you don’t suffer a financial catastrophe along with your travel mishap.

Keep in mind that most insurance programs you may have at home won’t cover you overseas.

Also, as good as the insurance programs offered by your credit cards may be, they only offer limited protection.

Lastly, the insurance programs offered by your airline, car rental company or cruise line are the bare minimum. You need a serious, robust policy to ensure maximum protection.

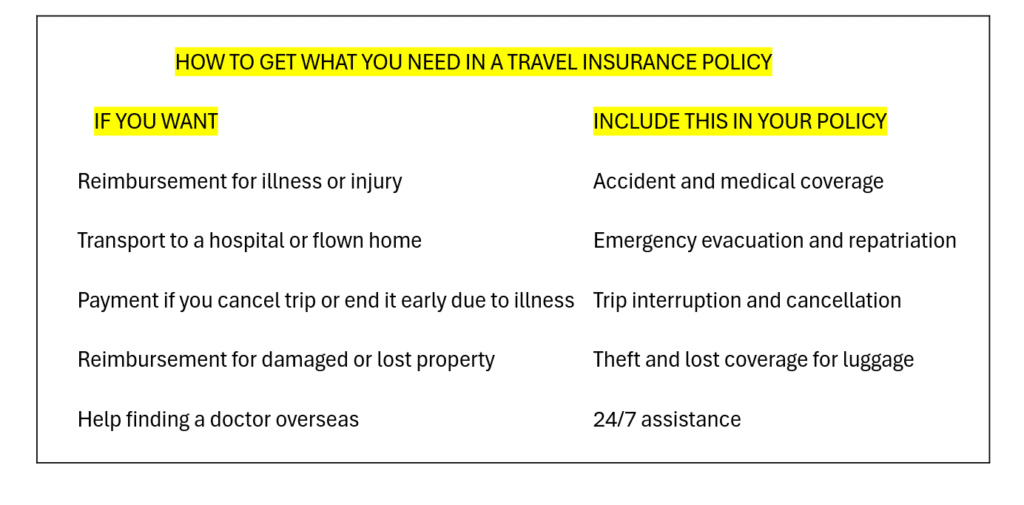

What You Want in a Great Travel Insurance Policy

There are an infinite number of choices when it comes to insurance. Not only with companies but also with policies.

The terminology is frequently obtuse and can often be misleading. This can make buying insurance so overwhelming that it is tempting to just avoid it.

Even after research and due diligence, you may overlook the fine print and, when you need it the most, you realize you may not have bought what you thought you did, or not enough.

Fortunately, there are a few top features that make an ideal insurance policy. The first thing you need to look for is that the policy offers high coverage for your medical expenses. What’s high? US$100,000 is reasonable.

People do purchase higher coverage, which is fine, but that’s a good figure.

If there is one thing you don’t want is to have an accident and run out of money as you’re being treated.

Hospital costs are steep. A broken bone in a skiing accident, a bad virus, a car accident. All these can wreak havoc on your finances.

It is also important to know that Medicare will not pay for your overseas expenses and most medical facilities overseas don’t accept your home health insurance.

Common traveler incidents requiring medical attention are:

- Traffic accidents such as vehicle crashes or people crossing against traffic in unfamiliar streets.

- Slip and fall. For example, slipping on the wet poolside, stepping into a pothole and fracturing an ankle, the very common “transfer trauma’ that occurs when stepping on stairs or off a sidewalk.

- Food poisoning. This can happen anywhere even in the best restaurants.

- Animal incidents. That monkey in the temple looked so cute until it bit you and the infected bite needed medical attention.

A second important coverage is medical evacuation. Whatever happens, you want to make sure you will be transported to an adequately prepared facility as quickly as possible.

If the injury or illness is severe, you’ll want to be evacuated to the best possible facility regardless of the location or the type of transportation necessary to get you there, like a helicopter.

Let’s say you’re in Europe happily exploring the wonderful museums. Suddenly there is a natural disaster like a flood. You want to be evacuated elsewhere quickly.

This is the “evacuation” part of “evacuation and repatriation” insurance. This protection should cover an expense of $200k to $300k.

The repatriation part would apply if, for example, you become very ill or break a bone and you need to be repatriated, meaning brought back to your home country.

Note that most insurance policies will cover your hospital expenses just enough to get you to the nearest medical facility if the issue is not life-threatening, for example, a broken leg. They won’t pay to fly you to a facility in your home country unless it is a medical necessity.

The bottom line is, make sure you understand what, specifically, your travel insurance policy will cover. Read the fine print. Will they fly you home if you really need it?

You don’t want to be debating these issues on the phone while you’re in distress.

There is a company called Medjet that specializes in evacuation and repatriation insurance if you don’t want to stay in an overseas facility while you recover, and you want to make absolutely sure you are evacuated AND repatriated to your home country.

Most travel insurance companies won’t guarantee that. Check Medjet out. That’s all they do.

Your Government Representative Overseas Can Only Do So Much

Some travelers believe their government representatives will help. Yes, but not with everything.

For example, the U.S. government overseas can help you replace a stolen or lost passport, contact family overseas, help you find medical attention, and interact on your behalf with the local police.

However, they cannot pay for our medical expenses or to transport you to our home country.

How to Nail Down the Ideal Travel Insurance Policy

Every policy is going to be different but, generally speaking, the ideal policy should contain the following features.

- Coverage for injury and sudden illnesses. That goes without saying.

- Coverage for the country you will be visiting. If you are going to an out-of-the-way destination, like Burundi or Iraq, will they cover you there? Ask.

- Assistance 24/7. There has to be a readily available phone number with responsive assistance on the other end. You don’t want to be put on hold or told to call back on Monday. Yikes!

- If you travel with valuables like jewelry or important documents, you’ll want coverage for these in case they are lost, stolen, or damaged. Although I have to recommend you avoid traveling with valuable jewelry.

- Trip cancellation coverage for canceled hotels, flights, tours, and cruises if you have a death in the family, sudden illness, or accident.

- Coverage for “acts of god” such as natural disasters, political emergencies, or conflicts that cause you to cancel and return home ahead of time.

- Coverage if the company you’re traveling with suddenly goes under and leaves you stranded. Remember that round-the-world cruise ship that went bankrupt and left a boatload of passengers stuck in Turkey?

- Coverage for your electronics. Many companies won’t cover electronics beyond a small amount. Make sure you have the option to purchase additional coverage, especially if you travel with expensive equipment like cameras or computers.

Don’t skimp on your travel insurance. If the price for a policy is significantly cheaper than others, ask yourself why.

Chances are the policy won’t cover what you need or what you think it covers. Maybe the payouts are smaller or there are so many conditions it’s almost impossible to get reimbursed.

What’s Not Covered By Your Travel Insurance

It’s important to have a good understanding of what your travel insurance policy won’t cover. This way you won’t be surprised with the unexpected and you can take steps to ensure you avoid doing what you know the policy won’t cover.

As a general rule, below are the circumstances most policies won’t cover.

- Pre-existing conditions. If you suffer from asthma and get a severe asthma attack, your policy won’t cover you.

- Stolen or lost cash.

- Expenses resulting from accidents sustained as a result of participating in activities generally believed to be extreme or dangerous. These can include, shark-cage diving, paragliding, bungee jumping, skydiving, or speedboat racing to mention a few. It is possible to obtain insurance for these activities but not all companies provide it, and the cost can be very high.

- Any incidents resulting from alcohol or drug use like injuries resulting from a drunken brawl.

- Carelessness and recklessness. These conditions are open to interpretation and each company may have its own criteria. However, carelessness can be defined as, for example, leaving property unattended in plain sight in an unlocked car.

- General checkups. That’s not what travel insurance is for and your policy will not cover it.

- If you’re in a country that suddenly erupts into civil unrest and you need to get out, but your government hasn’t declared an emergency evacuation, you probably won’t get reimbursed. This also applies to weather emergencies like hurricanes. The key is whether or not your government has declared a state of emergency. In the U.S., it is the U.S. State Department Travel Advisory that declares travel risks. Keep in mind that the U.S. government recommends its citizens to get travel insurance. It’s right there on their website.

Thoughts on Cancel for Any Reason Coverage (CFAR)

There’s been a lot of talk about the CFAR policy, especially post-Covid. With this policy, you can cancel up to 48 hours before departure and be reimbursed typically up to 75% of costs (check details with the insurance carrier).

Don’t Check the Box

One thing to remember when considering travel insurance is: “DON’T CHECK THE BOX.” You know that little box at the end of an airline ticket purchase, or just after you buy a cruise, or while you rent a car? The one that encourages you to buy insurance? Don’t check it!

Sure it’s convenient, but you may be surprised at what you get – or don’t get – when you actually need the insurance.

Insurance should be a carefully considered purchase, not an afterthought.

Buying travel insurance can be a confusing and overwhelming process. Here are a few tips to make it a little easier to understand how to settle on the right plan that suits your specific needs.

When should you buy your travel insurance?

The answer is, as soon as you make your first payment on your trip.

The reason travel insurance companies want you to buy insurance as close as possible to the first payment on your trip is that they want to make sure you didn’t buy the insurance AFTER something happened.

Let’s say you buy a tour and go on about your business with no intention of getting travel insurance.

Suddenly, one week before the tour you fracture a shoulder and the doctor says you can’t go. You buy the insurance, cancel the trip, and file a claim.

Since the claim will require a doctor’s note, it’s clear the accident happened BEFORE you bought the insurance. Your claim will be rejected.

The same situation applies in the event of inclement weather. If a hurricane forces you to cancel your trip, your insurance will only cover you if you bought the insurance before the hurricane occurred.

Sure, you can buy insurance up until the day you depart as long as the policy is activated. But, every day you wait, the chances go up that something bad could happen and you won’t be able to get the insurance AFTER an incident.

This is why insurance companies will always ask you when you made the first purchase on your trip.

If you only paid a deposit, buy the insurance to cover that amount and then increase your coverage as you continue paying for the trip.

The bottom line is, don’t wait to get your insurance. Buy it as soon as you make your first payment on your trip, or even before.

When considering travel insurance, do your due diligence. First, do some comparison shopping. Evaluate several companies and what they offer.

Make sure you understand what is really covered. Read the policy in detail before you buy.

I like to use Travelinsurance.com because the site lets you compare companies and policies. Once you determine what policy is suitable for YOUR specific needs, you can purchase online.

Travel insurance is designed to keep you whole after unforeseen expenses. It’s there to protect you against catastrophic situations that could lead to financial ruin and to get you home in a hurry if need be.

As a percentage of your total trip, the cost of travel insurance is minimal. Especially when compared to what you could be financially responsible for should you encounter an emergency.

There are stories out there of people having to take out credit card loans to pay for emergency expenses.

Don’t play Russian roulette with your health, valuables, or even your life. Always buy travel insurance.

What are your experiences with travel insurance? Was it there when you needed it? Let us know in the comments.

BTW, if you are getting ready for your trip, make sure to take advantage of these useful, money-saving links to book your trip:

- Research and book your flight with Skyscanner. I have found them to be the best because they list all airlines including the budget ones. You are always sure of having researched all options.

- For car rental around the world, Discover Cars has flexible pickup and drop-off options, I recommend Discover Cars.

- Book your accommodation with Booking.com. I find they have a wide selection and a nice, user-friendly, transparent website.

- Protect your trip and, more importantly, protect yourself with travel insurance. I use Travelinsurance.com and have been very happy with them.

- Looking for a small group tour to unforgettable destinations with top professionals? Intrepid Travel is your choice.

- For more general tours to any destination or attraction, book with Viator. Check them out.

- Need a visa? Get your visa for all countries with Passport Visa Express.

- Looking for a cool walking tour to explore a city? My favorite walking tours are offered by Take Walks.

- Food and drink tours are the best way to enjoy a city. And Devour Tours are my favorite.

- Looking for a good VPN to protect your security, privacy and freedom online while traveling? Nordvpn is your best option.

- The best and most economical way to stay connected while traveling is with an Airalo eSIM.

I personally use, and can recommend, all the companies listed here and elsewhere on my blog. By booking through these sites, the small commission we earn – at no cost to you – helps us maintain this site so we can continue to offer our readers valuable travel tips and advice.